Insurance association of Vietnam (IAV) shared, in the first 8 months of 2018, the insurance market keeps maintain the development process with total revenue of overall market up to 37.141 billion dong, gets increased 24,5% compared to 2017.

Insurance association of Vietnam (IAV) shared, in the first 8 months of 2018, the insurance market keeps maintain the development process with total revenue of overall market up to 37.141 billion dong, gets increased 24,5% compared to 2017. Therein, non-life insurance accounts to 14.519 billion dong, increased 13,8%; the revenue of life insurance accounts to 22.622 billion dong, increased 32,5%.

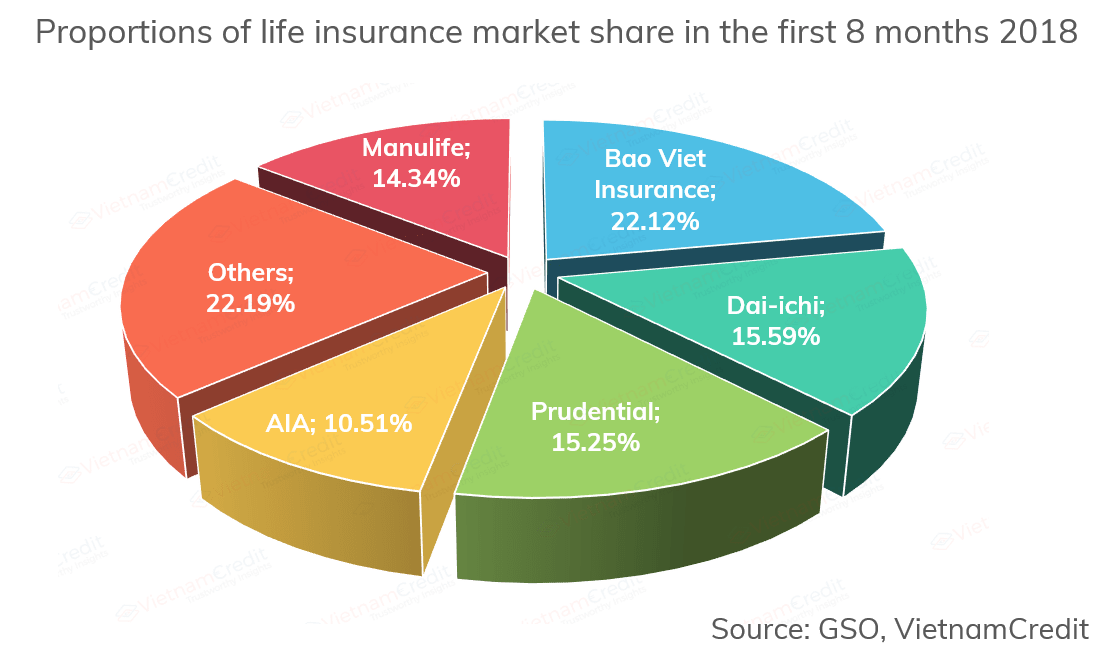

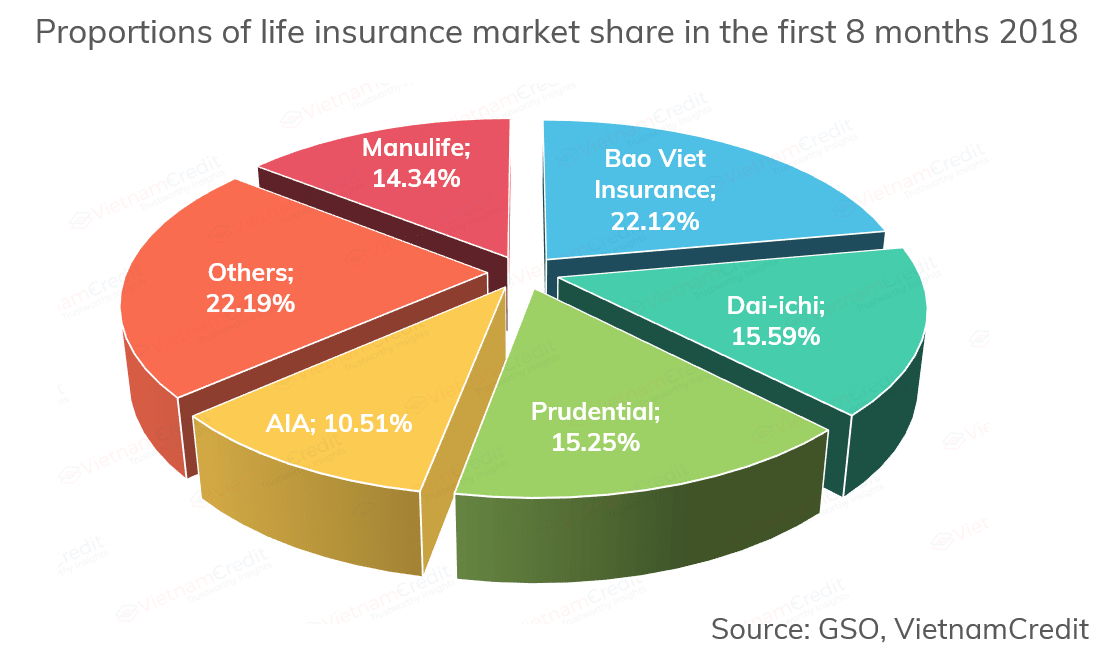

TOP 5 BIGGEST INSURANCE COMPANIES IN THE EARLY STAGE OF 2018

-

-

-

-

-

It’s worthy to say that market share in revenue of non-life insurance and life insurance is getting out line of the order and growth speed.

Especially in market share of non-life insurance, Top 5 insurance companies call out Bao Viet Insurance, PVI, PTI, Bao Minh Insurance, PJICO that dramatically decreased from 70% to 60% (2017).

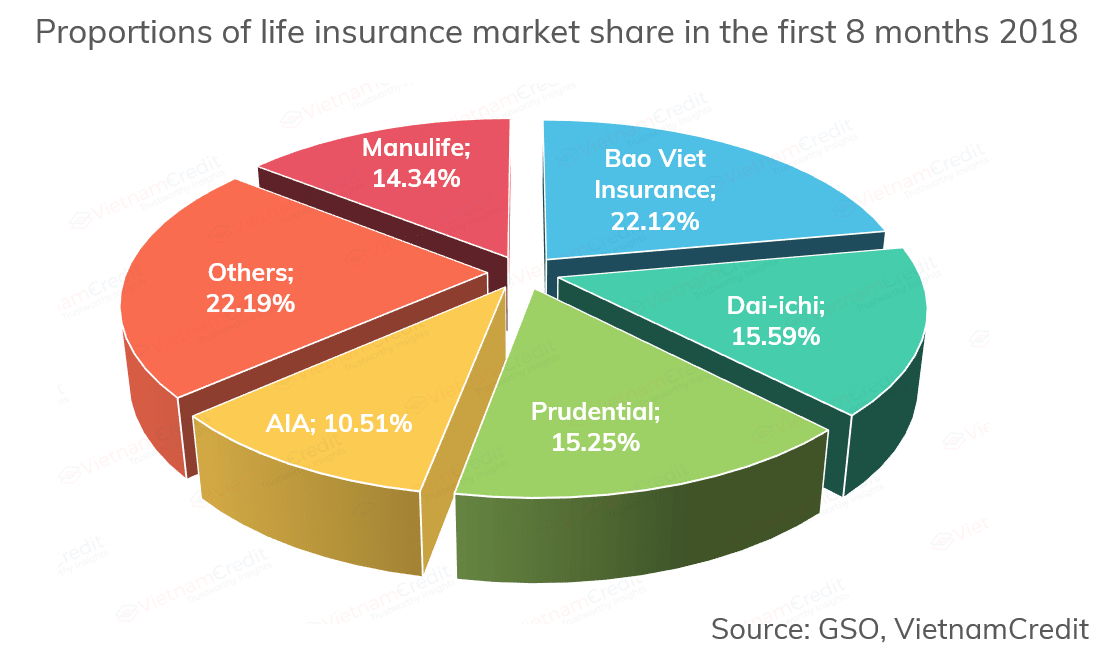

In the land of life insurance, Bao Viet Insurance is still the leader with 22,12%, and changes of 4 next spots as: Dai-ichi surpasses Prudential to rank at no.2 with 15,59% (in the end of 2017, it was Prudential), No.3 with 15,25% calls out Prudential, Manulife missteps to no.4 with 14,34%; Ranking at no.5 is AIA by 10,51%.

It’s the reflection of these developing statistics on non-stop progress of companies and fierce competition as well. Not only the big companies have taken the precious opportunities, but also the companies which come later, are continuously thriving and racing.

According to the estimated business schedule in 2018, the big companies like Bao Minh forecasts the target of total revenue around 4.318 billion dong, increases 5,6%. For PTI, PJICO are 5 – 10% upper compared to 2017.

In fact, during the first 2 months of 2018, Bao Minh gets increased 5,14% in the gross written premium; and PJICO is 3,48%.

Meanwhile, there are many small companies expecting for 12-20% upper from revenue in 2018: MIC is trying to achieve 2.500 billion dong, up 20%; VNI is still on their way for 1.000 billion dong, increases over 25%.

Otherwise, many insurance companies plan to increase charter capital, expand business network. For example, Sun Life Vietnam has just been approved by the Ministry of Finance to raise its chartered capital to VND1,870 billion.

Rigorous competition

According to the insurance experts, the market share of insurance is such a potential land due to low number of issued people. The people’s living standards get higher, the more awareness increases. However, the experts consider that potential always contain the huge challenges inside. The competition of market share is not only getting hotter than ever, but also becomes rigorous and tough.

The report of the Insurance Regulatory Authority shows that with the number of life insurance companies (18 companies) and non-life insurance companies (30 companies) that are operating in the Vietnamese market today, “market share playground” will be witnessed the super fierce competition among between large, medium and small companies.

It could be said that, during the pass, there are many insurance companies which come after, but get breakthrough amazingly by effective solutions such as: network expansion, cross sales …

Otherwise, Otherwise, in the scene of the explosive 4-way industrial revolution, the trend of boosting online sales has also been firmly applied.

For BIC, they are focusing on expanding the retail network, especially selling through banking system (bancassurance), also controlling strictly the compensate activities…that brought great outcome.